» As mentioned in my New Year's eve entry, which represents an attempt by a concerned citizen-parent to wrap his head around the incomprehensible and portray the problems plaguing the future of our nation's economy » I am no Economist. But ..

.. I'm starting to see articles (posted by professionals) that appear to echo points I made ..

.. about our economy being "heavily-medicated" for an increasingly troubling length of time ..

.. about our economy being "heavily-medicated" for an increasingly troubling length of time ..

.. such as » THIS ONE, posted by Bloomberg, which references an interview conducted with the erudite James Grant, who uses the term » over-medicated ..

.. while he was discussing the government's response to the recession of 1920 that helped shorten its duration.

Probably just a coincidence. New Years eve, you might recall, is when I wrote »

"A little medicine can be a good thing. A great thing, even. But when the medication NEEDS TO CONTINUE .. over an extended period .. that's a bad sign. Because, IF IT CONTINUES .. the road (in my experience) always leads to » death."

IF you followed my line of reasoning in that entry ~ ..

.. posted 4½ months ago, and which was intended to be a fresh look at our nation's storied economic problems .. with eyes that have not been academically indoctrinated ..

.. by the acceptance of predefined concepts .. which can lead to predefined (within-the-academic-box) thinking .. and result in predictable, but inaccurate conclusions. (See t=8:20 here for an example of what I mean.)

So I come from a very different background, which gives me a decidedly different perspective .. than the regular commentators you normally hear discussing the economy ..

.. and especially since readers claim I have a knack for discussing sophisticated concepts in ways that ordinary folk can easily understand .. breaking it down into easy-to-chew bite-sized morsels (.. cuz that's how I like to chew them myself) ..

.. ~ THEN you know that the "long-term heavily-medicated patient" was my own concocted analogy .. for the State-of-our-Economy, based on my own Life Experiences.

It was an intuitive analogy .. one that I wasnt even sure was valid, which is why I included copious hyperlinks .. to identify & support the basis for my concepts. [ Regulars know how I strive for the authenticity that comes only from original thought. ]

Not that I would ever complain about a professional taking up where I left off. Especially not one who wears a bow tie and might become our next Chairman of the Federal Reserve. =)

Speaking of the Federal Reserve .. here's another article you should see .. which helps make my point.

Speaking of the Federal Reserve .. here's another article you should see .. which helps make my point.

It contains a comment from the President of the Dallas Federal Reserve Bank, Richard Fisher, who says (paragraph 6):

"Adding to the accommodative doses we have [already] applied, rather than beginning to wean the patient, might be the equivalent of medical malpractice."

Here's one more .. again, from my good buddy Rich over at the Dallas Fed:

"We don't need any more monetary morphine."

I added bold-type. If nothing else, this confirms the validity of my analogy .. according to people who would certainly know. And you must admit, his comments are very clear. No need to guess or hire a double-speak interpreter.

Rad Ego

It's no big deal (NBD) .. but, uh, I have not been able to find any articles that reference the use of an analogy that is anything similar to one that compares our economy to that of a "long-term heavily-medicated patient" .. posted PRIOR TO the New Year.

The first was that Bloomberg article, quoting James Grant, which surprised me. It is dated February 14, 2012 (Valentines day). The articles quoting Richard Fisher are dated March 5 and March 22, both 2012.

So if you happen to find one dated earlier than December 30, 2011, or even before February 14, 2012 .. please kindly forward me a link. Gracias. Cuz my ego is convinced » "Dude! They are totally reading your shit!" =)

No mere mortal can guarantee that they're always accurate, but I *do* try to think for myself and retain an element of healthy skepticism when it comes to widely-held beliefs ..

.. which is something we ALL need to do a little more often .. cuz the current thinking obviously isnt working very well .. especially not for our kids .. as many seem to agree.

The Oracle & the Iceberg

The Oracle & the Iceberg

But, wait! There's more! Cuz New Years eve is when I also said:

"So .. when I look out over the valley that is 2012, what do I see? You should hope I have no prophetic gift ..

.. because I see it getting ugly, or I see it getting worse .. just below the layer of FOG sitting there."

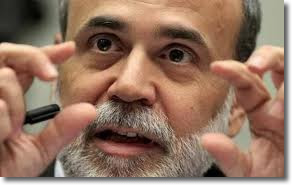

And smack dab between Grant's Valentines day comment and Richard's the very next month came one on Feb 29 [ leap year day ] from Bernanke himself ..

.. who happens to be the closest thing we have to an Economic oracle .. who warned Congress about a "massive fiscal cliff" coming on January 1st, 2013 (.. now 7½ months away).

The phrase "fiscal cliff" is a term that some people interpret to mean "disaster" .. cuz, uh, that's what usually happens when you walk off a cliff. (And you know what they say about 13 being an unlucky number.)

Instant recession. Just add water. Political water. As the politically independent CBO confirms. So our leaders can't claim that they didnt see it coming .. like they did last time.

And some economists think things might start getting squirrely well BEFORE January 1st .. amid "uncertainties" surrounding the rapidly approaching precipice. Fear of the unknown. (See t=2:45 here.)

The Fiscal Cliff

The Fiscal Cliff

Some economists think it would be best if we just jump off the fiscal cliff ..

.. while others think that the effects of the Fiscal Cliff could be WORSE than many anticipate.

This article, for example, by an economist at BoA is titled » "Fiscal Cliff May Make Europe Look Like a Dip."

I said VALLEY. Ben said CLIFF. Coincidence? (You can easily see the date on the Bernanke article.)

Either way, you must admit » Ben does look a little scared, and his choice of words there is surprising .. uncharacteristically alarmist for one of our economy's biggest cheerleaders.

Like me, Ben is also using geographical terrain as a METAPHOR for the future of our nation's economy .. tho my view also includes the SOCIAL ramifications. Because, while many Economists ignore them, the two can't be separated.

Now I will concede that a VALLEY may or may not be bordered by a steep CLIFF (.. perhaps a gentle slope).

But clearly, Ben is talking about a particular type of cliff .. one that proceeds from » high ground to low .. just like the view taken in of my valley .. that I "look out over" (.. and not up from below).

In other words, neither one of us is talking about the kind of geography that you climb .. but rather the kind that involves a drop .. whether it be it gradual or abrupt.

[ As if the Fiscal Cliff werent bad enough, Goldman Chief Economist Jan Hatzius is now predicting a "Monetary Cliff" to accompany our Fiscal Cliff. (You can't make up this stuff, folks.) ]

The Unsinkable Economy Headed Straight for Massive Congressional Iceberg

It wasnt long before everybody standing on the Fiscal Deck of the USS Economy in the thick forecasting fog that frigid leapyear night said, "Cliff? Yikes! Iceberg! Dead ahead! Sound the alarm! Admiral Ben said it's massive!"

[ Cant you almost hear the music playing in the background? .. where the rich survived and the poor died .. in the freezing-cold waters of the North Atlantic on the night of April 15, 1912, exactly 100 years & 1 month ago ..

.. cuz there were not enough lifeboat$ to save everybody .. as the unsinkable sank. ]

We have already seen what our leaders are capable of (.. or should I say incapable of) .. during the last raising of the debt-ceiling.

We have already seen what our leaders are capable of (.. or should I say incapable of) .. during the last raising of the debt-ceiling.

And guess when the next round of debt-ceiling dialogue will be? [ Pause for effect. ]

That's right .. I shit you not. It could NOT come at a worse time. Like a perfect storm, it will coincide perfectly with Admiral Ben's fiscal precipice .. uh, I mean cliff.

Some claim we might even reach the debt limit (ceiling) BEFORE election day. Talk about an October surprise.

I must admit, you guys are certainly very good at keeping things interesting for John Q. My toes tingle nearly all the time. "Lively!" as Long John Silver would say.

Does it not seem that our nation's economic problems are starting to become more POLITICAL than economic?

Because the point at which our economic problems become Political .. is the point at which we find ourselves enmeshed in a bona fide CRISIS. A crisis of confidence, if nothing else.

At the ugly end of our political Bell Curve, there's no telling how nasty things could get.

Here's how you'll know when our Economic problems have morphed into a Political problem » when the economy starts to suffer as a result of political dysfunction. For example, one economist says here (10th paragraph):

"The cliff is likely to hurt growth this year as much as next year. By risking a recession-sized fiscal contraction and then offering no guidance to how it will be resolved, politicians are creating a major uncertainty shock."

Regarding a solution to our current situation (.. which he terms a "Depression") Krugman says at t=1:20 here » "The economics is actually quite easy. It's only politics that stands in the way." [ And no, he doesnt stutter. ]

I would contend that day has arrived. Because our dysfunctional political system looks UNFIXABLE. Or are you seeing something I'm not?

Am I the only one who feels a little uneasy about our government's ability to deal with unconventional challenges? I think not.

Am I the only one who feels a little uneasy about our government's ability to deal with unconventional challenges? I think not.

Our economic leaders have already proven their incompetence. They have already demonstrated their ineptitude.

And the way that they "FIX" these problems (.. that they themselves create) .. is uh, by asking Congress to forkover mind-blowing amounts of taxpayer money (.. borrowed from China and put on our kids' credit card).

That's like your neighbor saying, "Sorry about my bar-b-q catching your house on fire. But at least I called the fire department and had them put it out. Here's the bill, by the way."

I do not know what would become of global financial markets, but I suspect the mere specter of a United States default would be most unsettling.

This might be a good place to mention that .. it has become clear .. that Wall Street's financial wizards are much smarter, craftier & dedicated than Washington's regulators ..

.. who, time & again (& again & again & again & again & again & again & again & again & again & again & again) have proven themselves either INEPT or willingly ignorant .. just like the government they represent.

Incompetent or bought off? Does it matter? Which would be worse? Meanwhile, Wall Street has figured out how to flourish regardless which administration takes office. Because they own both parties.

Your buddies at Wall Street damn near flush the whole economy down the pooper .. and you cant find a single thing wrong? "Looks kosher to me." Actions speak louder.

Yet let somebody tell a few of your secrets and you're suddenly all up in arms. So you can see why we feel your priorities are outta whack .. like you're looking for love in all the wrong places.

Regarding your secrets .. we're living in the Information Age, the Digital Age. Remember? Don't worry, you'll get used to it. It takes everybody a while.

As Steven Aftergood says: "Secrecy cloaks not only the operations, but their justification and rationale, which are legitimate subjects of public interest" .. for affairs that you guys are doing in the name of the American people.

I know it seems hard to believe .. but even after we drop off Ben's "massive fiscal cliff," the nation will STILL be running massive fiscal deficits.

See this video (at end of article) at t=9:15 to hear the Chairman discuss the Fiscal Cliff with members of Congress. Watch his lips at t=10:40.

••• today's entry continues here below •••

S&P Warns of "Perfect Storm" Brewing in Global Credit Markets

Perhaps even more unsettling is a new report from S&P ..

Perhaps even more unsettling is a new report from S&P ..

.. that warns of a "Perfect Storm" currently brewing in our Credit Markets ..

.. with winds that have been calculated to reach speeds of 46 Trillion miles per hour by the time it makes landfall.

Hold on to your financial hats. [ Podcast posted » here. ] Some sites call this warning a ploy.

You remember S&P. Standard & Poors. They're the folks who downgraded U.S. debt last summer (.. the nation's first-ever downgrade). And are threatening another downgrade, when they said:

"Recent shifts in the ideologies of the two major political parties could raise uncertainties about the government's ability & willingness to SUSTAIN public finances consistently over the long term."

Fitch has also threatened to downgrade U.S. debt if Congress can't get its fiscal shit together.

Then there is Nouriel's Perfect Storm. So take your pick. Choose your poison.

Derivatives #1 Biggest Threat to Economy

The thing however, that MOST concerns me (.. and scares the bejesus out of many people much smarter than me) .. are » the DERIVATIVES ..

.. because they remain unregulated (.. as Brooksley can confirm) and everybody acknowledges that they were at the very heart of the 2008 meltdown.

There is a reason WHY, after a brief introduction, the mind-blowing 4-hour Frontline special, titled » Money, Power & Wall Street, BEGINS with an explanation of DERIVATIVES ..

.. what they are .. from whence they came .. who came up with the idea .. how the idea originated .. and how these derivatives themselves came into being. [ Truly fascinating. ]

The REASON (it slowly comes into focus) is that » these derivatives are how/why/where our financial crisis BEGAN. The root of the cause.

And they're still there. Nothing has changed. Derivatives remain unregulated. They represent the Wild, Wild West of financial instruments. "Financial weapons of mass destruction" they have been called.

And they're still there. Nothing has changed. Derivatives remain unregulated. They represent the Wild, Wild West of financial instruments. "Financial weapons of mass destruction" they have been called.

Capitalism is about profit and loss. When companies make a long series of bad decisions, they eventually go bankrupt, creditors take a loss and the markets move on. No moral hazard.

So why isnt this happening? Why isnt Capitalism being allowed to work? Why are bankrupt institutions being bailed out?

One reason » derivatives. A tall stack of financial derivatives .. towering much higher than you could ever imagine.

Financial derivatives were invented by the United States (at JP Morgan), and everybody still remembers that it was problems at US banks, and with the US credit markets, which catapulted the the entire world into the financial mess we find ourselves still mired today.

The term subprime still carries ominous implications when spoken aloud .. with an effect that causes the Rest-of-the-World to lose trust in the Leadership capablities of the United States government.

Because every time you guys make another boneheaded-mistake, folks around the world naturally become less likely to listen (.. no matter HOW much money you give them).

The reason banks don't want the Derivative "market" regulated .. is cuz they can MAKE A SHITLOAD OF MONEY. The problem however .. is that (.. similar to the situation you find at a Las Vegas casino) they can also LOSE a shitload of money.

And that's where the American taxpayer comes in .. to the rescue of stupid gamblers placing stupid bets with government-backed money.

These companies can LOSE so much money that our ENTIRE ECONOMIC SYSTEM is put at risk. Are profit$ really worth that much to them? [ Apparently they are. ]

Warren Buffett, a man who happens to know a little something about investing and the way financial markets work, called derivatives » "financial weapons of mass destruction."

[ You might want to re-read that last sentence, paying particular attention to the qualifications of the author, an 81-year old man admired round the world for his folksy investing wisdom ("the Oracle of Omaha," they call him) ..

.. not infallible, but certainly one of the greatest investors of all time, and someone who has spent his entire adult life studying the financial markets. There's nothing flashy about the man. His results speak for themselves. ]

My question, then, is » why, pray tell, would you not regulate the very thing that is jumping up & down, shouting, "I did it! I did it! Me! Over here! I'm the one who came |THIS| close to taking down your entire economy, Me! Captain Derivative!" ??

I'll leave that question rhetorical for now. Ben? Richard? James? Anybody?

I'll leave that question rhetorical for now. Ben? Richard? James? Anybody?

Cuz if the taxpayer has to bail-out Wall Street again .. it will not be pretty ..

.. especially if the reason is because the government shuns its responsibility to provide necessary regulatory oversight .. cuz they are inBEDwith Wall Street.

The real troubling thing however .. is that this might not even be the worst scenario. Because this article at Investopedia (6th paragraph) estimates the derivative market to be (.. long-ass drumroll, please) » $516 Trillion.

That's right » $516 Trillion. It's not a type-o. Compare that with our accumulated national debt, which, at nearly $16 Trillion, is itself a mind-blowingly big number. 16 vs 516.

In other words, the market is TOO BIG to regulate. Too-Big-to-Fail banks operating in a Too-Big-to-Regulate market .. a market that has been called a "ticking time bomb".

And that article was written back in 2008. God only knows how big the market is now. Tho Senator Byron Dorgan says at t=20:00 in video #1 posted here .. that in 1999, there were $33 Trillion in derivatives held by United States banks & financial institutions.

This article says that NOW our 9 largest banks hold a total of $230 Trillion in Derivatives .. 3 times the size of the entire world economy .. which is roughly $70 Trill .. give or take.

So .. $33 Trill at/near the beginning of 2000 to $230 now in 2012. Notice anything about that growth rate? If my math is correct, that's a ~600% increase in dozen years. What effect is this having on the stability of our economy?

Speaking of $70 Trill .. of these BANKS, JP Morgan has the most, holding $70 Trillion worth of Ticking Derivatives (TD's).

No government in the world has money for this kind of bailout. Here's a book about TD's titled » "Traders, Guns & Money." [ What?! No lawyers? You must be shitting me. ]

Grexit = Greek Exit | Disorderly = Chaos

And nobody really knows WHAT would happen if Greece leaves the Euro (.. called a 'Grexit'), or if the Euro blows up .. seeing that the EU is an economic union which some call "Inherently Flawed" (.. by design) .. because it is governed by many different political systems (governments).

This plays well, I feel, to the point I made near the beginning of my New Years eve entry .. in my "collegiate coincidence sidebar" ..

This plays well, I feel, to the point I made near the beginning of my New Years eve entry .. in my "collegiate coincidence sidebar" ..

.. where I said that the Economic system is inextricably entwined with the Social / Political system .. and that they are impossible to separate.

As tho one defines the other, and cannot exist without the other. Does it not?

Now you might think it would be no big deal for the EU to flip off the Greeks with a flying atomic raspberry and say,

"Gimme back my EU coins & hit the Currency Road, Jack .. all the way back to your broke-ass little island."

BUT! [ Pause for effect.] There's a problem with that. A big problem. A DEBT problem.

Remember how the credit markets of the entire GLOBAL economy seized up back in 2008? (How could we forget?) Some say a Grexit could be worse than when Lehman Bros failed.

While the Economics editor of the Economist magazine (Ms. Beddoes) says (at t=0:50) that a Grexit "could precipitate a financial crisis WAY WORSE than Lehman Bros."

And the best explanation I heard is that » "The SYSTEM is designed such that every chain in the system depends on every other chain holding up its end of the bargain .. and if ANY ONE PART of the system breaks down .. then the WHOLE thing IMPLODES."

It's all interconnected via a type of financial derivative called a Credit Default Swap.

"Jamie, could you please come over here and explain to the folks how a CDS works?" It's a like a BET .. that a person/party will or won't pay their debt.

At t=9:40 in the 1st video posted here, they say that a CDS is "a kind of financial derivative that insures a loan against default" .. by paying someone else (another company) to assume the responsibility associated with the RISK of that loan going bad.

CDS's allowed banks to "skirt" capital requirement safeguards (see t=12:30 in video #1 posted here). The problem here is twofold:

- [ Remember AIG and the $85 billion bail-out? They couldnt pay. Also Lehman. Hank hated the gorilla Dick Fuld so he let Lehman fail .. relishing the event I would imagine.

governments (such as Greece & Spain & Ireland), just like companies (such as AIG & Bear Stearns & Lehman Bros) & citizen-consumers (such as you & me) can't pay what they/we dont have.

And just like that goes Goldman's biggest competitor .. down the drain .. largest bankruptcy filing in US history. Ever. A company that was founded in 1850 .. in Montgomery, Alabama.

Meanwhile, Goldman Sachs was founded 1869. And Bear Stearns » 1923. Bear Stearns was bought by JP Morgan, which traces its history back to 1799. ]

- winning your derivative bet means you might actually end up breaking the system, or a good part of it. [ If the party has so many losses that they can't pay .. like AIG.

.. which is why some are calling for Credit Default Swaps to be not merely regulated, but OUTLAWED outright.]

I heard the explanation about how derivatives work .. that if any one part of the chain breaks, then the whole system implodes .. from Satyajit on Money, Power & Wall $treet .. tho I cant tell you the exact timecode right now. I'll see later if I can find it for you.

So .. even tho Greece is considered a pissant little economy, it has the potential to wreck havoc in the financial markets .. especially is they get pissed off. [ This page answers the question "Who loaned Greece money and how much? ]

If this is true, and Greece knows it, then this knowledge could allow them to drive a hard bargain. No? Which might be exactly what they are doing.

Cuz Greece seems to be saying, "Show me the bailout money, but you can forget about that austerity baloney .. like you did with Spain. Homie dont play no austerity game."

And Germany seems to be saying, "No austerity ticket, no uber ride on the German Bailout Express."

But how the EU handles Greece will be a big thing, a big deal, significant .. because:

- It will set precedents.

- Spain is next. And Spain has a much bigger economy.

- Italy is also looking a little green around the economic gills .. with Europe's highest debt-to-GDP ratio.

- Even France is starting to feel the pressure, having its debt downgraded to a step or two from "junk" status.

- All this affects Germany, who seems to be the only one who can hold the Euro Zone together.

I mean, it would not be very difficult to fuck things up .. seeing such a thing has never before been attempted.

I mean, it would not be very difficult to fuck things up .. seeing such a thing has never before been attempted.

Given the recent near-cataclysmic page of history that our greedy economic leaders have already written for us, I am naturally wary about their assurances of success ..

.. in executing the Greek big-toe amputation without killing the Euro-patient .. and infecting the rest of the world.

They call it "contagion." Contagion is the result of the world's newfound interconnectedness. "The global economy" looked like a good thing .. until all the world's economies became inDEBTed to each other (.. some more than others).

That is the point of infection .. the thing that provides a conduit for contagion.

In the 3rd slide listed here, titled "Risk of Contagion" they quote a Harvard economist named Kenneth Rogoff as saying that the Euro Zone is "the ultimate contagion machine."

The term they use to describe a scenario whereby things get really fucked up .. is » disorderly. A disorderly exit. This cracks me up .. cuz, as everybody knows, Disorderly is a town on the road to Chaos. =)

And it is difficult to imagine a scenario by which a Greek exit would be orderly. If I was Greece and exiting from the EU, I would put on some James Brown and turn it up. Papa dont take no mess. =)

I could be wrong, but it seems like this would give the Greeks a certain amount of bravado .. arrogance, even .. as could only be demonstrated by the nation who invented Civilization itself (.. okay, they'll settle for Western Culture). "Moderation in all things," right?

But anybody who can spell 'World War' knows that the Germans have gotten a shitty deal .. more than once .. and I suspect they are more than a little FED UP with getting the shitty end of global economic stick. Wouldnt you be? I mean, that is the very thing that caused WW2.

Cuz .. "to the victors go the spoils" .. and this time around, they have taken a commanding position .. which allows them call the shots. "My way or the highway."

And everybody knows that Germany would have to be the main source of financial salvation for the Greeks (.. and the entire Euro Zone) .. cuz they're the only ones who still have an operating economy .. that has any kind of real money (.. or even better » CREDIT).

What would you do if you were Germany?

What would you do if you were Germany?

The head of German Banking says here (at t=0:25), "We can't go on like this forever, dude."

Only he doesnt say, "dude."

The German people themselves (not necessarily their politicians) feel that the economies of the Southern countries (such as Greece, Spain, Italy, Portugal) .. represent a financial "bottomless pit."

Seems to me that the German have no reason nor desire to keep bailing out the endless line of faltering economies, especially now that it's starting to get expensive with Spain.

I bet they say something like » "Nothing personal, but we're tired of giving you Greeks so much money that we know you're never gonna repay .. cuz that's how you Greeks are."

The term 'brinkmanship' has been used to describe the interplay between Greece & the EU/Germans.

The word is defined as » "The art or practice of pursuing a dangerous policy to the limits of safety before stopping, typically in politics."

Interesting quote posted here (1st & 2nd paragraphs):

"The Tokyo market slumped to a 28-year low on Monday as Asian shares dived on fears of a nightmare scenario of euro-zone breakup, U.S. economic relapse and a sharp slowdown in China."

"The Nikkei last week marked its 9th straight week of losses, the longest such losing streak run in 20 years."

Interesting quotes here. For example (2nd paragraph):

"The European Commission's top economic official, Olli Rehn, warned that the single currency area COULD DISINTEGRATE without stronger crisis-fighting mechanisms and tough fiscal discipline."

and another quote, mid-way down the page/article, just after the heading titled "EDIFICE AT RISK:

"Another ECB policymaker, Bank of Italy governor Ignazio Visco, went further, saying political inertia and bad economic decisions had put "the entire European edifice" at risk and only a clear path to political union could save the euro."

Sounds dire, no? Here's another eyebrow-raising quote (5th paragraph):

"Europe's problem, much like in the United States in 2008, is that its financial SYSTEM IS FRAYING. Troubled countries and weakened banks alike have difficulty borrowing money to sustain their operations as nervous investors pull back from risk."

Curious quote posted here (3rd paragraph) that says the Currency Union "largely benefits the more prosperous members like Germany." Really? I didnt know that.

And here's the most eye-popping quote that I've read since beginning my research for the New Years eve entry.

From Alexis Tsipras of the Syriza party, Greece. He says (2nd paragraph answer to 1st question):

From Alexis Tsipras of the Syriza party, Greece. He says (2nd paragraph answer to 1st question):

"At the same time, we will try to restore faith in the law and convince people that the state is equitable and effective.

We will destroy corruption and the interconnection of political and economic power from its roots."

Corruption and cronyism have long been a problem in Greece and is the main reason cited for its current economic predicament.

Because such "interconnection" is what my New Years eve entry was all about. "At its roots" .. uh, that would be » the palm, Alexis. (People have been assassinated for saying less inflammatory things.)

Here's what I said about "destroying the interconnection (corruption) of political and economic power" .. in my New Years eve entry (~¼ down the page):

"Seems to me that .. when the wealthy & the powerful both want the same thing (.. such as a mechanism for getting more wealth and more power) .. uh, such a mechanism shalt not be easily disabled."

In the case of Spain, it must be a gut-wrenching place to be in .. being faced with a decision to have foreign powers take control over and dictate their financial decisions .. in order to get the money they so desperately need. But what else can they do?

Talk about being between a rock and a hard place. Seems almost like selling your soul .. a concept that many believe the German people invented.

A good 9-minute video is posted at the end of this article. In it, the former Deputy Treasury Secretary Roger Altman says (at t=30 secs): "The moment of truth for the Euro Zone is rapidly approaching."

His Op Ed is posted » here (Washington Post). I was struck by the sobering quality of the phrase » "moment of truth". Because he does not seem like a man given to hyperbole.

I have also heard it called the "Moment of Reckoning" for Europe.

Another quote that popped out at me came from this guy, who says (at t=0:50 secs) » "Greece always had the threat of causing contagion, but Spain IS infected."

Another quote that popped out at me came from this guy, who says (at t=0:50 secs) » "Greece always had the threat of causing contagion, but Spain IS infected."

And people are concerned it will spread to Italy, whose economy is even bigger than Spain's. (Only France & Germany are bigger than Italy.)

A key point here is that Germany has already BEEN THRU this austerity stuff. And it was no fun for them. So they think »

» "If we can do it, then you can, too. And we'll be damned if we persevere thru the hard times in order to get where we are now .. then turn around and bail out your sorry asses with our hard-earned money. We're not gonna trash our economy for you spendthrift low-lifes"

Unlike the United States & the our Federal Reserve, Germany & the ECB take seriously moral hazard. That's a cultural difference.

If you check out this interactive (rollover) overview of who owes what how much, you can see that Spain owes France TWICE as much as it owes Germany .. and Italy owes France a humungous amount, while it (Italy) owes Germany nothing.

In other words, a default by either Spain or Italy would hurt France FAR MORE than it would hurt Germany. Think about it.

Rating agency Fitch recently downgraded Spainish debt by a dramatic 3-steps .. almost to junk status.

Here's an interesting development that says France is now teaming up with Italy and Spain to take on Germany. I wonder if this stirs in the German people any old memories .. any unresolved issues? How can it not?

Meanwhile, France had the Credit Rating on their debt downgraded several steps to bbb+ .. which can't be good. Anything rated below bbb- is considered "junk" (non-investment-grade).

What's that cracking sound? It's the sound you hear right before an irresistable force hits an immovable object.

Dr Laura says Disorderly Greek Exit #1 Biggest Threat to Economy

The impressively pedigreed and papered Berkeley professor Dr. Laura Tyson, who holds a PhD in Economics from MIT and who sounds very rational, says HERE (at t=2:10):

"The biggest danger to the World Economy and to the U.S. economy is a disruptive, disorderly exit of Greece [ from the Euro Zone ] which causes a major seizure of Credit Markets in Europe.

The European banking system is the largest in the world and is very CONNECTED to the banking systems of the rest of the world.

So you can't rule out the possibility of some dramatic seizure of capital markets. That's the greatest risk. It's not the recession in Europe itself."

She says all this while holding out her hands .. as if unconsciously trying to contain the problem. =)

If I'm not mistaken, she was one of the people interviewed for the Commanding Heights video ..

If I'm not mistaken, she was one of the people interviewed for the Commanding Heights video ..

.. which formed the basis for my original post on New Years eve. I had been watching that video for much of December, just before bed. (Made for great dreams.)

I remember replaying that section over a few times. Then again, there were many sections that I replayed over & over (.. out of disbelief).

Oh yeah, I found her. Here she is. I knew it. (She seems smarter now.)

At t=5:50 in this video, these guys say that Greece falling out of the Euro would be WORSE than Lehman Bros, which is what nearly took down the entire US economy in 2008. "Worse," they say .. these guys who have been following the crisis since day 1.

And I should remind you what was said by the Economics editor of the Economist magazine (Ms. Beddoes) (at t=0:50) that a Grexit "could precipitate a financial crisis WAY WORSE than Lehman Bros."

The head of Britian's Treasury Dept said (at t=0:50), "This is an exceptionally grave moment for the whole world economy." The video is less than 3 mins, but you might wanna grab a beer before watching it. Sobering. The "whole world economy," he said.

Here's an article posted at Time, titled » Euro Crisis: Why a Greek Exit could be Much Worse than Expected. Subtitled » More than one kind of damaging domino effect is possible if Greece is forced to abandon the Euro. It is the best article I've been able to find on the subject.

Here are a few more good ones »

- Greek Exit May Exceed 1 Trillion Euros (Bloomberg)

- Facing a Teetering Greece, Europe Plans for the Worst (NYTimes)

- The euro's parachute drop has no end in sight (CNN Money)

The Euro has fallen to its lowest level in 2 years on Grexit fears.

Meanwhile, Plosser says that the escalating Euro-crisis might actually HELP the US economy.

But Bullard counters by saying, "Europe is a potential risk to the global economy and it is up to European governments to follow a plan that reassures financial markets they can repay their debt."

It will be interesting to see who has the more accurate crystal ball.

This article at Forbes, titled "Now Spain Circles the Drain," says that Spain's problems are above and beyond and separate from those related to the Grexit. In other words, even if Greece doesnt exit, Spain is still in a world of hurt.

And Spain's has a MUCH bigger economy than Greece. Spain has Europe's 4th largest economy (.. after Germany, France & Italy).

Stiglitz Clarity

Stiglitz Clarity

Of all the research I've done regarding the Euro Zone's problems .. THIS video (6 mins), which features an interview with double-Nobel laureate Joseph Stiglitz of Columbia (NYC), sheds the most light.

[ My Navy buddy, the Dog, graduated from Columbia. Civil Engineering. ]

Here are some eyebrow-raising quotes. At t=3:00 mins, Stiglitz says:

"It's a vicious cycle. There's only one solution » a unified financial system. A banking system for the whole Euro area. Which means you cannot rely on the Spanish government to bail-out the Spanish banks. It must be a European banking system with European finance backing all the European banks."

At t= 5:40, he says:

"The question is, are they [Europe] at the point where there's nothing more they can do? I think they're almost there. A European-wide guarantee on money in deposit in Spanish banks is necessay to make people feel safe about depositing their money.

But Germany says, 'We won't do that; we won't bear that risk.' That's a STALEMATE. And if they don't do that, the system FALLS APART FAIRLY QUICKLY."

Is that video saying what I think it's saying? Very illuminating. Must-see. Easy to see why Stiglitz has started himself a collection of Nobel Prizes.

See here tho, for an apparent contradiction.

[ As a crafter-of-words myself, I confess to admiring the way Stiglitz is able to craft such clarity into his writing. Is that him? Or does he have a gifted editor? His speaking-interview is also mui claro, so I suspect the Stiglitz clarity comes from the man himself. ]

Speaking of stalemates .. notice that Bernanke has also suggested (2nd paragraph) that Republicans & Democrats are likewise at a STALEMATE [.. a term the President himself, at t=4:50, has begun using ..] over how to deal with the infamous Fiscal Disaster (uh, I mean » Cliff).

And speaking of good videos, Bernanke says here (bottom of article) at t=5:50:

"The situation in Europe poses significant risks to the U.S. financial system and economy and must be monitored closely."

Does Ben not look horrible in that video? Like he hasnt slept in days? (Nice tie, tho.) Check out the look he gives when he says the words, "must be monitored closely." Then check out the looks on the faces of the guys sitting on the panel. Priceless.

In keeping with the tenets of web site optimization, today's entry has been broken into THREE PAGES. Part 2 is posted here » Geeks vs the Government | Game On - Part 2